“Compound interest is the 8th wonder of the world… Those who understand it earn it… Those who don’t pay it.” ~ Albert Einstein

Thanks to the efforts put in by financial gurus, a lot of people are aware of the concept of compound interest. For those of you a little dubious about the same, here’s a quick definition:

‘Compound interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Compound interest can be thought of as “interest on interest,” and will make a deposit or loan grow at a faster rate than simple interest, which is interest calculated only on the principal amount.’ ~ Investopedia

Being a retirement solution provider, we help our clients realize the benefits of compound interest and one of the best ways to do so is to contribute towards a tax-deferred retirement account.

Why invest in a tax-deferred retirement account?

- Compounding of your money: Your money enjoys tax-deferred growth for several decades, accumulating more interest with every passing compounding cycle.

- Qualified deductions: By contributing to a tax-deferred retirement account, you are eligible for qualified tax deductions, hence reducing your tax bills right away.

Couple compound interest with a Roth Solo 401 k & Get Tax-free Distributions*

How about combining the magic of compound interest with a Roth Solo 401 k account?

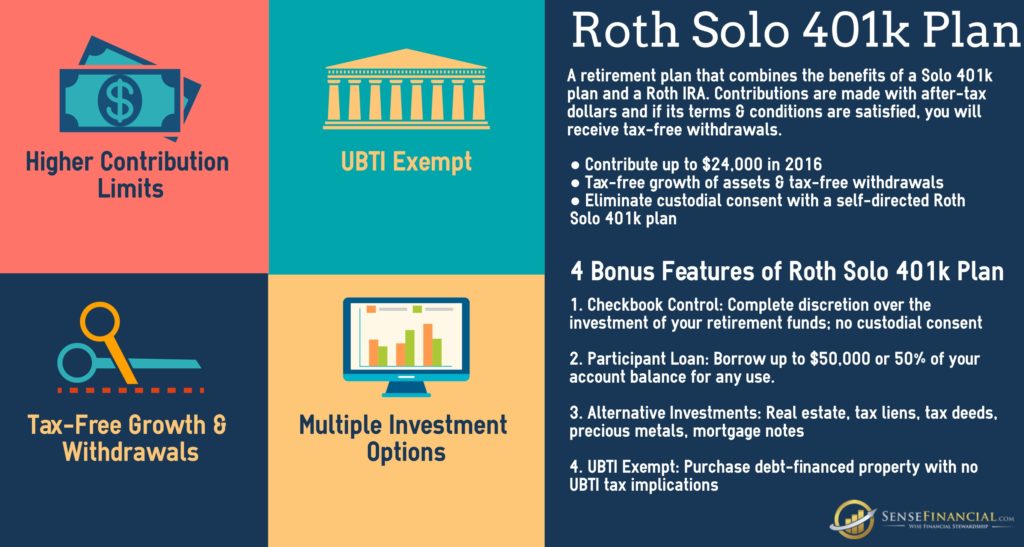

A Roth Solo 401k account is a retirement plan for self-employed professionals and owner-only businesses, allowing after-tax contributions. Under the plan, the account owner pays taxes upfront and in return, they receive tax-free distributions.

- Annual contributions: $24,000 in 2016 (including catch-up contributions of $6,000 for professionals above 50 years)

- No income restrictions: Unlike a Roth IRA, there are no income restrictions for making eligible contributions to a Roth Solo 401k plan.

- Tax-free withdrawals: If your Roth Solo 401 k account satisfies certain conditions, you can receive tax-free eligible distributions in retirement.

Here is a short Infographic to highlight some of the primary features of a Roth Solo 401k plan:

Comments